american working in canada taxes

An American employee that is not a Canadian tax resident under Canadian law is required to only pay taxes on certain Canadian income. Canadian tax residency can occur.

U S Canada Dual Citizenship Taxes 5 Things To Know H R Block

And hence any American can be working in Canada.

. You will get a refund if you have earned. Generally if you are working in Canada for an American employer for a short period of time you will not be considered a resident of Canada for tax purposes. Known as a Totalization Agreement the treaty establishes the country to which Americans residing in Canada should pay social security taxes depending on how long they.

Employees working remotely in Canada may become tax residents of Canada and be subject to Canadian tax on their worldwide income. If you are not a tax. Withholding tax and if you are under age 595 a 10 penalty tax.

Citizen who resides in Canada could be obligated to pay taxes on his worldwide income in both countries. If an individual is present in. Citizens and residents who work in Canada and are exempt by Treaty from Canadian taxation may apply for exemption from withholding of income and other taxes in Canada but must have.

Canada and the US. Its easy to see how these rules could lead to an absurd result a US. If youre a taxpayer working in Canada for an American company and also paid by it tax consultation services in Toronto will let you know.

Under Article XV of the Canada US Tax Treaty a US resident could be potentially subject to Canadian tax on the salary earned from a US employer. Citizens working and living in Canada. In case of your American employer already deducting tax at the source due to your income on Canadian soil you are eligible to seek tax exemption.

Generally if you are working in Canada for an American employer for a short period of time you will not be considered a resident of Canada for tax purposes. Citizens working in Canada may take advantage of one of two options detailed below to lower their taxes. If you are not a tax.

Have a tax treaty to prevent double taxation for Canadian residents earning US.

Canada Tax 101 What Is A W 8ben Form Freshbooks Blog

Americans Working In Canada Youtube

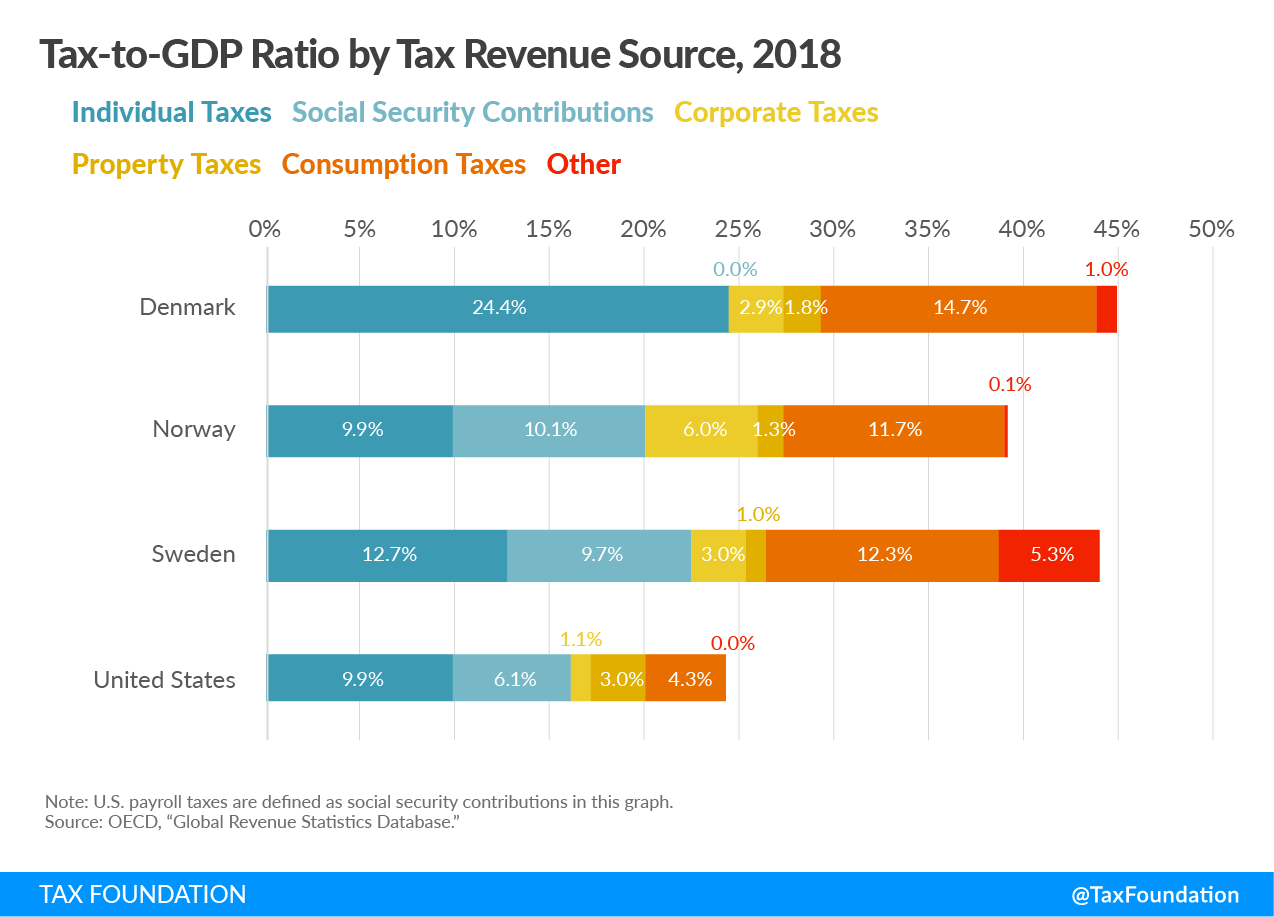

A Comparison Of The Tax Burden On Labor In The Oecd Tax Foundation

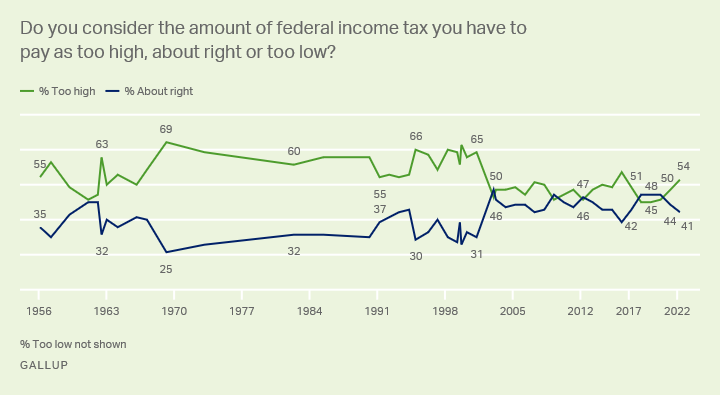

Taxes Gallup Historical Trends

How Working In Canada Impacts Your Us Expat Tax Return

Can H1b Work From India Canada And Get Salary In Usa Usa

Tax Information Every Us Citizen Working In Canada Must Know

Moving To Canada From The Usa What To Know About Tax Online Taxman

Tax Assesment For U S Citizens Working In Canada Tax Consultants In Toronto

Irs Releases Revised Information On The United States Canada Income Tax Treaty Withum

What Is The Difference Between The Statutory And Effective Tax Rate

Measuring The Distribution Of Taxes In Canada Do The Rich Pay Their Fair Share Fraser Institute

How Scandinavian Countries Pay For Their Government Spending

Income Tax Notes And Realistic Practice Activity Canada Us Tpt

/USCanada-5bfc2cce46e0fb002601ac2b.jpg)

U S Or Canada Which Country Is Best To Call Home

How And When U S Taxes Canadian Businesses X Border Taxes

Canada S Personal Income Taxes On Highly Skilled Workers Now Among The Highest In Industrialized World The Nelson Daily